In 2022, it is called the "darkest moment" of China's tires. Under the influence of logistics blockade, high raw material costs, the heavy truck market slump and other factors, 112 of the 369 domestic tire enterprises suffered losses in 2022, and the average profit margin of the industry is only 2.2% -3%. Since 2023, the tire market both domestic and external demand have come out of the bright data, the first three quarters of the tire start load remains high, tire production, tire export volume increased significantly year-on-year, the profits of many tire manufacturers has been significantly improved compared with last year.

As a major tire producer, China accounts for more than one-third of the global output. In global tire trade policy tightening with China, "double reverse" investigation for a long time, domestic tire industry production capacity, domestic tire manufacturers highlight, constantly improve the influence of domestic brands in the international market, further occupy the future market share at home and abroad, the reason became the key to the sustainable development of tires in our country.

"The world tire see China, China tires see Shandong", Shandong province in the international tire market position, through combing and study the development of Dongying city in Shandong province tire spot market development, to grasp the pulse of the tire market, insight into the tire market rhythm has important significance, Shandong tire manufacturers research is urgent.

1. Research background

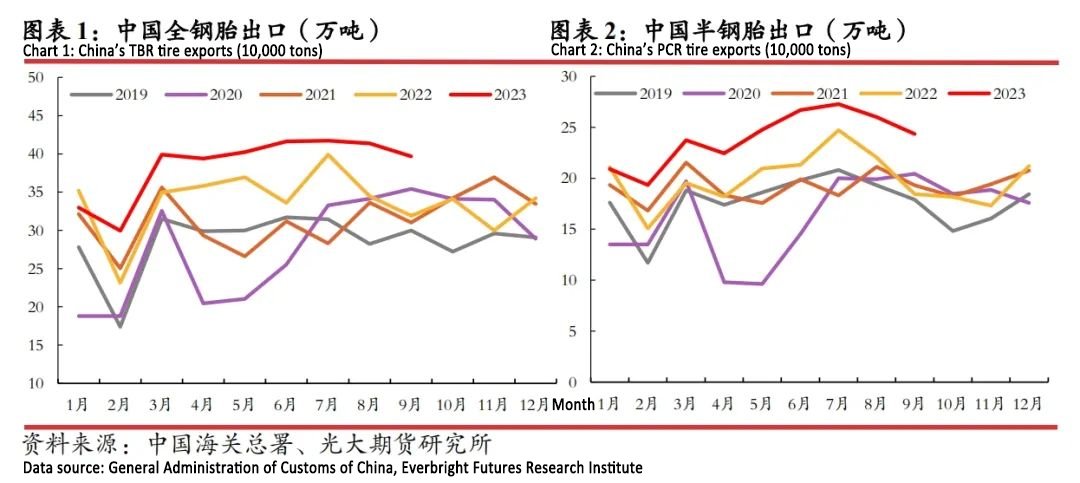

With the domestic and foreign market demand picked up, the tire industry boom is picking up. In 2023, the domestic tire production rebounded significantly compared with the same period last year, and the export market performance is very bright. The double support of domestic demand and external demand also makes China's rubber market change substantially. According to the data of the General Administration of Customs, in the first nine months of 2023, China's cumulative export of rubber tires was 6.65 million tons, up 14.7%; the export amount was 117.043 billion yuan, up 19.1%. How is the performance of the domestic tire market this year, whether there is room to continue to rise in the future market, and the use of the futures market geometry, urgent field investigation and research.

China is the world's largest tire producer, and Shandong is the country's largest tire production province. Shandong has more than 300 tire enterprises, accounting for more than half of the domestic tire enterprises. Shandong province is also guiding the advantage of tire enterprises to become bigger and stronger."Shandong Province" fourteenth five "manufacturing strong province construction plan" plan, in 2025, Shandong Province planned tire industry output value to reach 200 billion yuan; sales revenue over 10 billion yuan tire enterprises to reach 8, including more than 2 over 20 billion yuan, 1-2 enterprises into the top 10 in the global tire industry."Dongying Rubber Tire Industry Development Plan (2023-2025) (draft for public comment)" also said that it will cultivate 3-5 global leading tire enterprises with operating revenue of more than 65 billion yuan.

In 2022, there were 72 rubber and tire enterprises above designated size in Dongying city, Shandong Province, with an operating income of 53.93 billion yuan. Among them, tire manufacturing occupies the leading position, with 35 enterprises above designated size, achieving an operating revenue of 44.18 billion yuan, accounting for 81.9%. At present, the comprehensive production capacity of Dongying city rubber tires has reached 194 million pieces. Among them, the capacity of all steel radial tire reaches 36.6 million / year, the capacity of half steel radial tire reaches 157 million / year, and the engineering tire capacity reaches 550,000 / year. In 2022, the output of radial tires in Dongying city reached 117.895 million, accounting for 1 / 3 of the output of Shandong Province and 1 / 6 of the national output, and the radial rate of tires reached 92.3%.

"The world tire see China, China tires see Shandong", Shandong province in the international tire market position, through combing and study the development of Dongying city in Shandong province tire spot market development, to grasp the pulse of the tire market, insight into the tire market rhythm has important significance, Shandong tire manufacturers research is urgent.

2. Research content

The first station of research: A large tire manufacturer in Shandong A

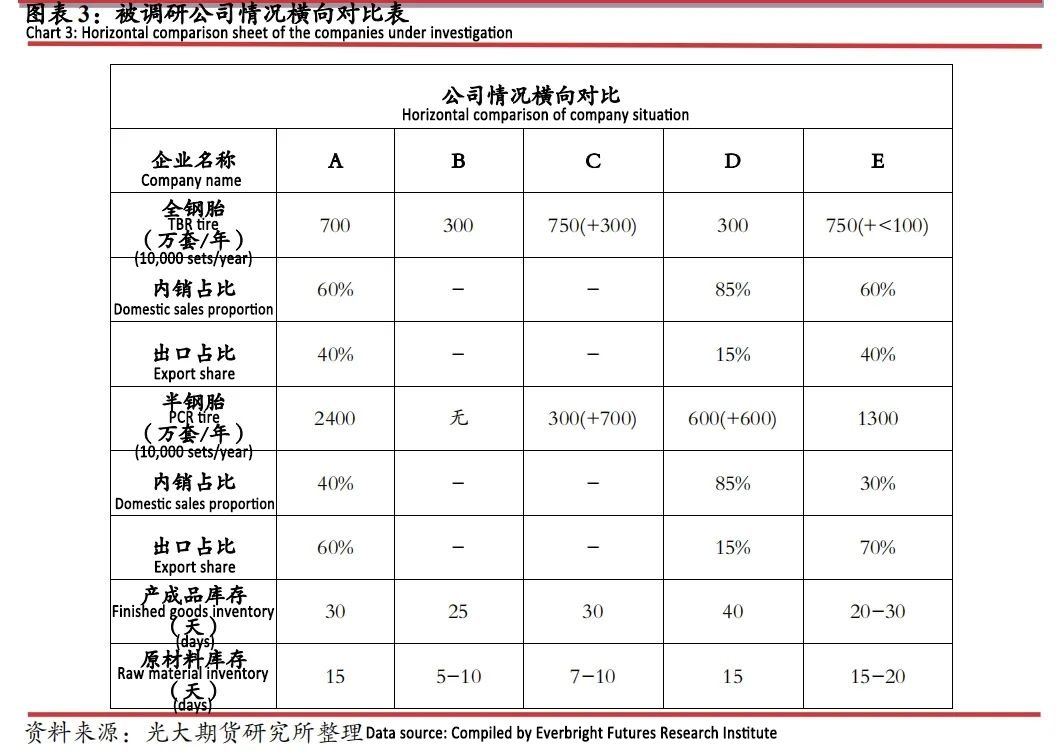

Company situation: at present, there are 5000 + 2 million sets / year full steel tire production capacity, 24 million sets / year half steel tire production capacity. Among them, all steel tires accounted for 60%, export accounted for 40%; half steel tires accounted for 40%, export accounted for 60%. The company mainly to replace the demand, supporting very few, domestic supporting will reduce the price profit is very low.

Device construction: the tire operating rate has basically been maintained, the preheating device is needed in winter, after the suspension of production on the equipment preheating cost of more than 10 million, from parking to full open needs 2-3 days, generally before and after the Spring Festival maintenance. From the seasonal perspective of tire sales, there are off-season and peak season, small peak season in March, April, off-season in May, June-October is the peak season for summer travel demand, before November, the northern winter snow tire tire demand is strong, November-before the Spring Festival is the off-season for tire sales.

Raw material procurement: raw material procurement the total purchase volume within the year is hundreds of thousands of tons, there are many kinds of rubber raw materials, raw materials of different properties will be purchased, mainly standard 20. tobacco. Raw material procurement cost does not change much, along with the purchase, rubber procurement market price, raw materials from Qingdao port. Synthetic rubber source Qilu Petrochemical, the annual purchase volume is also hundreds of thousands of tons. Import from traders, half a month in advance, refer to the Japanese rubber futures price a little more.

Tire sales: downstream sales spot cash, the trading object is mainly dealers.

Inventory level: the normal inventory of finished tire products is maintained at 30 days, and the inventory of rubber raw materials for half a month.

The second station of research: An all-steel tire manufacturer in Shandong B

Company situation: the company's annual output of 2-3 million sets / year all steel tire (TBR). At present, the company's business model is trusteeship commissioned processing, domestic sales and export, the proportion is uncertain.

Device start: the tire start is basically fully open, and the tire finished product type is adjusted according to the customer orders.

Raw material procurement: the import period of raw materials in Southeast Asia is about 7-15 days, which is the inventory in the bonded area. The big profit influencing factor is the fluctuation of raw material price, and there is the risk management demand of raw material price fluctuation.

Tire sales: domestic sales to all over the country, customers from the order to the delivery limit needs 40 days.

Inventory level: daily finished products maintain 25 days of inventory, about 400,000 tires. Raw material stock days within 5-10 days, spot trading.

The third station of research: A large tire manufacturer in Shandong C

Company situation: the company has 5.5 million sets of steel tires per year, 2 million sets per year. The annual capacity of 2 million sets of overseas steel tires will reach the designed capacity in July 2023.

Plant construction: the output is 6.24 million in 2022,6.27 million in September 2023, and is expected to exceed 8 million in 2023. Start work at full load and starts work. Maintenance is generally at the end of the year, maintenance time is about 10 days, from parking to full drive needs 3-4 days. The qualified rate of the products can reach 99.98%, and the finished products can be 100% inspected.

Capacity expansion plan: the total steel tire expansion of 3 million sets / year by the end of the year. The overseas production capacity of semi-steel tires is 10 million sets / year, with 3 million sets / year, 3 million sets / year and 4 million sets / year respectively.

Raw material procurement: annual purchase of about 40,000 tons of day rubber. Production + shipment in about 1-2 months.

Inventory level: normal in about 1 month, every Spring Festival and holidays will be ready. The raw material inventory level is 7-10 days, and the finished products will be stocked at the end of the year (December and January). With 300,000 units in stock.

The fourth station of research: A large tire manufacturer in Shandong D

Company situation: 3 million sets of steel / year of steel tires, 6 million sets of half steel tires / year, 60,000-70,000 sets of engineering tires / year. On the capacity expansion, the planned half-steel tire is put into production of 6 million sets / year. Domestic sales are the main ones, and exports account for about 15%. On the one hand, the RMB is depreciated, on the other hand, the export tax rebate is 9 points, and most of the export countries are Russia and the Middle East. Sales to replace, no matching.

Operating costs: labor + electricity + gas costs account for about 15%, raw material procurement accounts for about 60%, and other miscellaneous expenses account for about 10%.

Raw material procurement: the procurement mode is cash and spot T / T. Cash transaction, from Qingdao Huangdao bonded Zone, and traders to take goods, RMB settlement. The factory will carry out the raw material inventory hoarding behavior.

Tire sales: raw material prices rose in September, agents hoarded up, and October was relatively flat. Before the Spring Festival, before the National Day, agents take more goods, inventory increases. The order situation is in the purchase mode, and the full payment is paid before loading.

Inventory level: tire inventory, about 400,000 sets. Raw materials daily use 300 tons, can use 15 days.

The fifth station of research: A large tire manufacturer in Shandong E

Company situation: all steel tire 7.5 million sets / year, half steel tire 13 million sets / year. There are three physical factories. At present, there is no overseas factory construction plan, there is a full steel tire technology upgrade and expansion plan, less than 1 million sets per year. All steel tire 60% domestic, 40% export; half steel tire 30% domestic, 70% export. The company's tires from the previous low-end tire, these two years gradually to the high-end, can run remote, good wear resistance of the tire development. All for the replacement market, no supporting market, low profit.

Plant construction: almost full operation throughout the year, to maintain the workers' piecework, to prevent the loss of workers. Generally during the Spring Festival holiday, and maintenance, from the 18th day of the twelfth lunar month began to prepare, December 23 began to have a holiday, the eighth day of the first month to work.

Raw material procurement: the purchase quantity is stable, synthetic rubber has a small length of about, natural rubber has no length of about. The transaction object is the trader, the goods before the payment, the full payment bill of lading, the transaction cycle is 7 working days. Influencing factors of raw material procurement: the port inventory has less impact unless the inventory is particularly low; the purchase and storage behavior will affect the spot price in the short term with little long-term impact. At present, the day rubber procurement situation is good, traders chase to sell.

Tire sales: downstream customers have concentrated semi-steel tires, stable orders, and all-steel tire downstream customers are scattered. Sales profits are relatively stable.

Tire export: more export countries, the tire type exported to Russia is the full steel tire, Europe and the Middle East half steel tire export, Southeast Asia is more than the full steel tire, there is no half steel tire for the United States.

Inventory level: it will be adjusted according to price fluctuations, standard glue maintained at 15-20 days, steel wire cord maintained at half a month, and small material in 2-3 months. The inventory days of normal finished products are about 20 days, up to 30 days.

3. Research conclusions

This research activity visited the tire manufacturers of different production capacity in Shandong region, respectively supporting all steel tire and half steel tire production capacity. From the survey, this year's tire industry profit performance is better, compared with last year and the year before the industry profit has increased. Among them, tire exports accounted for a large proportion of the company, sales profit is better. All steel tire sales profit is good, half steel tire sales are larger.

From the perspective of procurement mode, tire manufacturers purchase raw materials in spot cash, and there is basically no advance payment or long contract. The full payment has been paid before picking up the goods, and the order cycle is short, generally 7 working days to half a month in advance. In recent years, the spot price of raw material rubber fluctuates less compared with 2008-2012, the amplitude is not more than 3000 yuan / ton, and there is no sharp rise or fall. In addition, tire manufacturers rarely take goods from the origin of rubber, and most of them purchase from Qingdao port. Risk such as overseas exchange rate risk, sea transportation fluctuation risk and transportation cost are transferred to import traders. Especially, third-party import traders need to use futures and other tools for risk management compared with downstream tire manufacturers. For tire manufacturers, although the raw material price is not locked in advance in the process of raw material procurement with the upstream, there are fixed trade traders who will communicate the purchase quantity in advance, quantitative but not pricing. Private enterprises have great flexibility in raw material procurement, and will conduct appropriate hoarding behavior according to the boss's judgment of the market.

From the perspective of sales model, the downstream tire manufacturers in this survey are mainly the replacement demand market, with no supporting demand market. The reason is that the supporting market mainly adopts foreign tires, domestic tire manufacturers get low profits, high requirements for tires, and there will be the behavior of pressure, resulting in low participation of domestic tire manufacturers. Downstream sales to agents around the country, from the customer order to get the cycle limit of the goods in 40 days, the order is basically short-term orders, no long-term contract, also in the form of spot cash trade. Different tire types of sales profit is different, the whole steel tire production threshold is high, the profit is relatively high, half steel tire production and sales are large, mostly small profit and quick turnover.

In terms of export, the number of tire exports increased significantly year on year, with the export of tires as the main business model of enterprise profit performance is better. The reason is that, on the one hand, due to the Federal Reserve continues to raise interest rates, the domestic interest rate policy continues to be loose, the RMB is depreciated against the dollar, and the exchange rate against the dollar is a good news for the domestic tire export market; on the other hand, the export rebate rate of rubber tire is 9%, which also stimulates the continuous increase of China's tire export volume. Export orders are also mainly short-term orders, without long-term trade. Exporting countries are all over the country, mainly in Europe and the Middle East countries, the demand for half steel tires is good, while Russia and Southeast Asian countries 'demand for all steel tires is greater, the anti-dumping and anti-subsidy investigation of the United States has limited most of China's exports to the United States. Companies are also expanding their share of the global tire market by investing overseas and re-exporting factories.

In the process of investigation, it is found that tire manufacturers mostly use short-term orders for raw material procurement and tire sales orders, with almost no long-term agreement, and the purchase and sales prices are adjusted with market fluctuations, and the shortest period of adjustment is about one month, which can maintain their normal operation. Enterprises have no great demand for the hedging of futures management tools, but they will pay attention to the futures disk price, including the previous natural rubber futures, 20 rubber futures, Japan rubber futures prices, etc.

Source: Photoperiod Energy Research Team

Qingdao Delphy Technology Development Co., Ltd. (DLFTECH) is a professional equipment service company established by a senior marketing and R&D team in tire equipment industry. Leading by tire automation process equipment demand, the company is committed to the docking of intelligent equipment and technology, to achieve zero distance technique process and bring new profit growth points and continuous market competitiveness to customers.

Please feel free to let us know any of your needs. Our email address is info@delphygroup.com