According to data released by the General Administration of Customs of China on May 18, in the first four months of 2024, China's rubber tire exports reached 2.86 million tons, a year-on-year increase of 5.6%; the export value was 50.6 billion yuan, a year-on-year increase of 7.1%.

Among them, the export volume of new pneumatic rubber tires reached 2.76 million tons, a year-on-year increase of 5.4%; the export value was 48.7 billion yuan, a year-on-year increase of 7.1%. Calculated by number of units, export volume reached 209.56 million units, a year-on-year increase of 10.8%.

From January to April, the export volume of automobile tires was 2.437 million tons, a year-on-year increase of 5.3%; the export value was 41.7 billion yuan, a year-on-year increase of 7.9%.

Driven by strong exports, China's tire production, especially semi-steel tire production capacity, continues to rise. According to estimates, in April 2024, China's semi-steel tire production was 57.42 million, an increase of 0.14% month-on-month and 5.01% year-on-year.

However, the performance of the all-steel tires was unsatisfactory. According to estimates, China's all-steel tire production in April was 13.51 million units, a month-on-month decrease of 5.79% and a year-on-year decrease of 3.71%.

Export volume of semi-steel tires decreased month-on-month

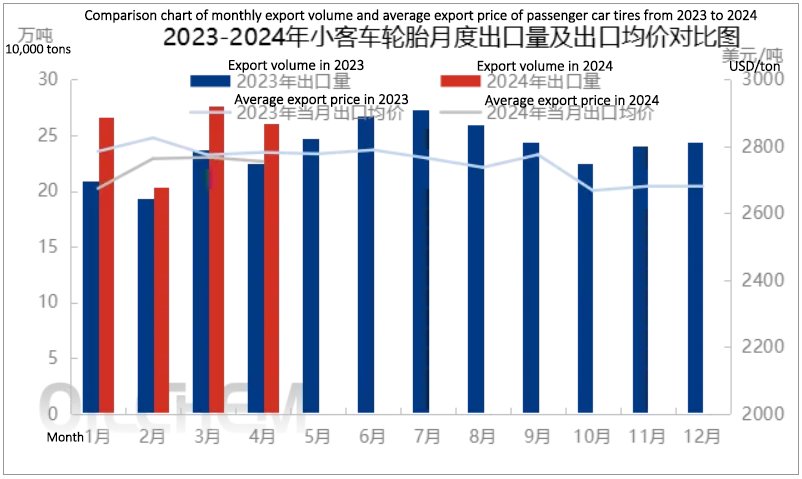

According to customs statistics, in April 2024, China's passenger car tire export volume was 260,100 tons, down 5.71% month-on-month and up 15.84% year-on-year. From January to April, the cumulative export volume of passenger car tires was 1.0055 million tons, a cumulative year-on-year increase of 16.31%.

In April 2024, the average export price of China's passenger car tires was 2,754.94 yuan/ton, down 0.45% month-on-month and 0.98% year-on-year.

The export volume of passenger car tires decreased month-on-month, and some export volumes were released ahead of schedule in March after the holiday. In addition, rising shipping prices and tight containers have affected export volume to a certain extent.

From the perspective of China's passenger car tire exporting countries, passenger car tire export volume declined in April 2024. The country with the largest export volume was the United Kingdom, with export volume at 24,100 tons, an increase of 15.81% month-on-month, export volume to Brazil ranked second, down 18.20% month-on-month, Russia's export volume ranked fourth, down 19.47% month-on-month.

Judging from the export performance of semi-steel tires since 2024, the first quarter of 2024 continued the strong trend of 2023, with the cumulative export volume reaching the highest level in history. The positive support for China's semi-steel tire exports in the second quarter may continue, and the second quarter gradually enter the peak export season, it is expected to provide greater support to the overall sales volume of the tire industry in the second quarter, which may exceed the same period last year.

Export volume of truck and bus tires is not optimistic

Compared with semi-steel tires, the export performance of truck and bus tires is poor. In April 2024, China's truck and bus tire export volume was 372,500 tons, a month-on-month decrease of 3.41%; a year-on-year decrease of 5.42%. From January to April, the cumulative export volume of truck and bus tires was 1.3995 million tons, and the cumulative export volume fell by 1.60%.

In April, China's truck and bus tire exports to the United Arab Emirates continued to rank first, with export volume at 25,000 tons, a month-on-month increase of 10.96%; Exports to Mexico and Saudi Arabia ranked second and third, with export volumes of 21,000 tons and 18,500 tons respectively, down 3.51% and 6.88% month-on-month respectively.

In addition, exports to the United States were 13,400 tons, a month-on-month decrease of 20.99%; exports to Russia were 8,400 tons, a month-on-month decrease of 29.32%.

In May, according to the survey on the order situation of all-steel tire companies, the largest proportion of company orders decreased in May, accounting for 70%. Domestic terminal demand performance has further weakened, vehicle replacement demand has weakened significantly, and channel inventory has been slowly digested, resulting in a reduction in domestic orders. In addition, export orders have also declined to varying degrees, dragging down the company's overall order volume. Judging from the export orders, 80% of the all-steel tire sample companies' export orders decreased compared with the previous month, and 20% of the all-steel tire sample companies' export orders remained unchanged from the previous month.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as tire mold intelligent laser cleaning system, OTR bead winding system, rubber track steel cord ply winding line etc., please feel free to contact info@delphygroup.com.