ERJ recently released the 2024 global rubber machinery industry performance report.

The report said that in 2023, the global rubber machinery industry's sales rebounded strongly, rubber machinery orders were obviously concentrated on leading companies, industry concentration increased, and the strong became stronger. The global rubber machinery industry's investment confidence has grown and investment willingness has significantly increased. China's rubber machinery shines in the global rubber machinery rankings. China's Mesnac Co., Ltd. topped the list for the second consecutive year, with a large gap from the second place, marking that China has become a major rubber machinery country and a "quasi-powerful country." The market situation continues to be optimistic, China's rubber machinery industry faces unprecedented opportunities to achieve the goal of "bigger and stronger" and is expected to become a "powerful country" in rubber machinery in the next 3 to 5 years.

The rankings did not change much, Mesnac topping the list again

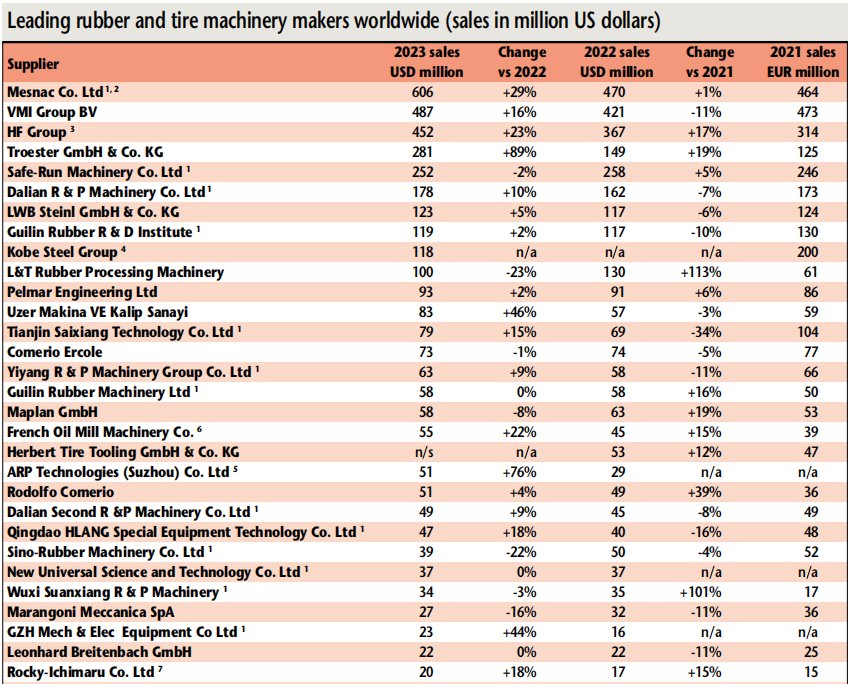

The global rubber machinery manufacturers ranking in 2024 is ranked according to sales revenue in 2023. Compared with the 2023 list, the ranking of global rubber machinery manufacturers in 2024 has not changed much.

1. The top three remained unchanged, and the sales gap widened

The sales revenue of Mesnac increased by 29% year-on-year (the same below), and with USD 606 million, it has been the leader in the world rubber machinery industry for two consecutive years. The sales revenue of VMI of the Netherlands increased by 16%, ranking second with USD 487 million. Germany's HF company's sales revenue increased by 23%, ranking third with US$452 million. The positions of the top three remained unchanged compared to the previous year, but the sales gap widened.

2. Chinese companies account for 4 of the top 10 and 14 of the top 30

Germany's Troester moved up 2 places to 4th. China's Safe-Run Machinery dropped one place to 5th place, Dalian Rubber & Plastic Machinery dropped one place to 6th place, and Guilin Rubber R&D Institute moved up one place to 8th place. Germany's LWB moved up three places to 7th place. Japan's Kobe Steel and India's L&T Rubber both dropped two places to 9th and 10th place respectively.

Among the top 10 rubber machinery companies, 4 are Chinese companies, 3 are German companies, and there is 1 each from Japan, the Netherlands and India.

Among the top 30 rubber machinery companies, there are 14 Chinese companies, 5 from Germany, 2 from Japan, 3 from Italy, and 1 each from the Netherlands, Austria, Israel, Turkey, the United States and India.

3. Two companies entered and two left the ranking

The two new companies that entered the ranking are China GZH Mech & Elec Equipment and Japan's Rocky-Ichimaru.

The two companies that dropped out of the ranking are China's Shaoxing Jingcheng Rubber & Plastic Machinery and Japan's Mitsubishi Heavy Industries.

Strong rebound in performance and increased industry concentration

1. Sales revenue rebounded strongly

Despite the ongoing challenges of global geopolitical and trade tensions, the global rubber machinery industry has quickly recovered. The main reasons are: First, due to the positive impact of China's development, the sales revenue of Chinese rubber machinery manufacturers increased by more than 12% to US$1.6 billion. Second, sales revenue of European companies, including Turkey, increased by 22% to US$1.67 billion, while the growth rate in 2022 was only 3%.

The total sales revenue of the top 30 global rubber machinery industry reached US$3.732 billion, an increase of 12.4%.

1) Growth becomes the main theme

Among the top 10, 7 companies saw sales revenue growth, while 3 saw sales revenue decline. Among the top 30, 21 companies saw sales revenue growth, while 9 saw sales revenue decline.

The companies with the largest growth rates were Germany's Troester and Turkey's Uzer Makina, while the companies with the largest declines were India's L&T Rubber, Japan's Kobe Steel and Austria's Maplan.

2) Global market share

Europe-based rubber machinery manufacturers accounted for 45% of the global sales revenue, the same as in 2022. Chinese rubber machinery manufacturers' sales revenue accounted for 43% of the global total in 2023 and 44% in 2022.

3) Product performance

The growth in sales revenue was mainly due to the growth of the tire and rubber machinery segment, while the non-tire segment was slightly lower.

When reviewing its performance in 2023, HF's parent company, Possehl Group, pointed out that the global automotive market is recovering, the number of original passenger car tires manufactured was significantly higher than in the previous year, but the replacement tire market continued to perform poorly. Thanks to the market recovery, sales revenue in HF's Tire Technology division returned to growth. Sales revenue of tire curing presses and rubber internal mixers both grew strongly, with new orders increasing significantly by 500 million euros. Among them, sales revenue of internal mixers increased by 25% in 2023, and new orders reached a record high.

2. Increased industry concentration

The report said that orders are clearly tilted towards leading enterprises and towards system solution companies that are good at intelligence and digitalization, and the phenomenon of the strong getting stronger is more obvious. The top three sales revenue accounted for 41.4% of the global total, an increase of 3.6 percentage points. The top 10 sales revenue accounted for 72.8% of the global total, an increase of 2.5 percentage points.

The development of Mesnac is a successful case. The company's annual report disclosed that sales revenue increased by 29% and net profit increased by 65% in 2023, mainly due to the contribution of digital and intelligent products.

VMI is another example of smart manufacturing success, with its parent company TKH Group reporting a 17% increase in sales revenue in its “Smart Manufacturing Systems” division to EUR 570 million in 2023. Order volume increased by 10% to EUR 630 million. Among them, tire building machine sales revenue accounts for about 75% of the company's total sales and more than 70% of the global market share. The company's new tire building machine capacity in Leszno, Poland, was put into operation in the second quarter of 2023, increasing delivery capabilities, and further expansion of production facilities will be put into operation in 2024.

Investment intention grows, optimistic about future development

ERJ designed a three-question survey covering investment direction, regional development, product segments, etc. The survey results show that rubber machinery manufacturers have generally felt the recovery from the market, and their investment willingness has increased significantly.

1. Fastest growing markets survey results

58% of respondents identified North America as the "fastest growing" region, down from 63% in 2023.

The highlight of 2023 is the positive sentiment in Western European markets and the solid recovery trend in the Chinese market.

The European market has shown resilience given the lingering impact of high energy costs, the Russia-Ukraine conflict and recently announced tyre plant closures. At the same time, Europe has attracted a lot of investment, especially from overseas tire manufacturers. EU economic sanctions against Russia have led to the relocation of tire manufacturing, boosting investment projects in Turkey and Central and Eastern Europe. At the same time, the number of automation and upgrade projects being implemented in European tire manufacturing plants is also increasing significantly.

29% of respondents are optimistic about the rapid growth of the Chinese market, up from 15% in 2023. Whether this rebound trend will be sustainable is a particular concern for tire and rubber machinery manufacturers.

2. Survey results of product terminal application areas

Globally, tire manufacturing reflects the characteristics and trends of local manufacturing, reduced inventory, integrated tire manufacturing systems and more efficient small-batch manufacturing. As the number and types of tires required by the market continue to increase, the flexibility of tire manufacturing is required to increase, while the technology that meets the latest performance and safety of high-quality tires is also required.

So in terms of terminal application areas, 67% of respondents believe that the "tire manufacturing" application area has always been the strongest terminal application area, which is the same as before.

Even as the auto parts industry recovers from post-COVID-19 supply chain issues, it remains fraught with uncertainty. The survey report shows that this year only 12% of respondents are optimistic about the application of automotive parts, indicating that the rubber machinery industry believes that there is uncertainty in the investment and development plans of automotive parts manufacturers.

At the same time, rubber machinery manufacturers are more optimistic about industrial applications and general rubber products applications than in previous years.

3. Future investment direction survey results

Consistent with the sales revenue and performance recovery trend in major markets, tire and rubber machinery manufacturers are formulating development plans and improving manufacturing capabilities.

The survey report shows that the respondents' intentions for "capacity expansion" and "upgrading/modernization" have increased significantly, and there are also planned measures such as acquisitions and integration to adapt to the changing requirements of the global market. Companies that have made business expansion or modernization plans include China SINO-ARP Tires Equipment, Germany's LWB, the United States' French Oil Mill Machinery, Germany's HF Group, Germany's Leonhard Breitenbach, Italy's Marangoni Meccanica, Japan's Rocky Ichimaru, Italy's Rodolfo Comerio, Turkey's Uzer Makina and the Netherlands' VMI.

Finnish company Cimcorp mentioned that tire manufacturers in Asia, Europe and America are increasing their investments in new automation projects. To address this trend, Cimcorp will focus on promoting "software solutions" such as the "tire manufacturing kanban system" to improve the efficiency of the vulcanization process.

Israel's Pelmar Engineering said it will develop customized overall production lines to improve manufacturing system efficiency and reduce waste.

Japan's Rocky-Ichimaru mentioned that the company plans to expand its business in India.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as electron beam irradiation system, tire laser engraving machine, green tire separant automatic sprayer, etc., please feel free to contact info@delphygroup.com.