Recently, China's listed tire companies have released their 2023 performance reports and revenue and profits in the first quarter of 2024, once again refreshing the latest rankings in the tire industry.

In 2023, due to multiple favorable factors such as rising raw material prices, recovering demand in domestic and foreign markets, and the rapid growth of new energy vehicles in China, the operating conditions of tire manufacturers in the past year have generally been positive.

In 2023, 10 listed tire performed well

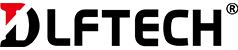

Judging from the financial reports of listed companies, in 2023, all 10 A-share tire companies achieved double-digit growth in revenue. Sailun Group ranked first in listed tires with 25.978 billion yuan. Linglong Tire broke through the 20 billion mark for the first time, and Triangle Tire broke through the 10 billion mark for the first time, becoming the top three listed tire companies.

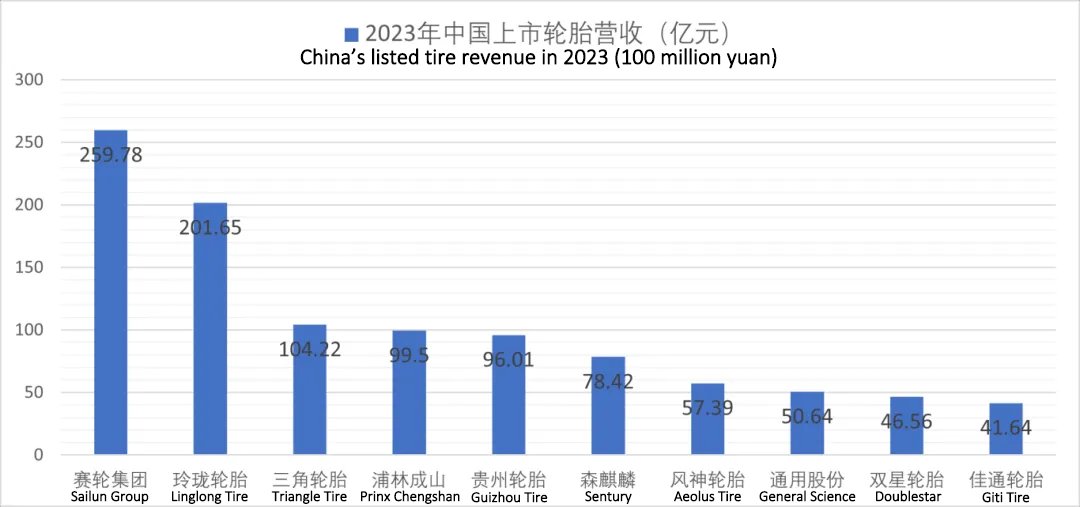

In 2023, Sentury continued to maintain a high growth trend, with annual revenue increasing by 24.63% year-on-year in 2022, ranking first among all listed tire companies. In addition, General Science and Prinx Chengshan also maintained performance growth of more than 20%, taking their scale and strength to a new level.

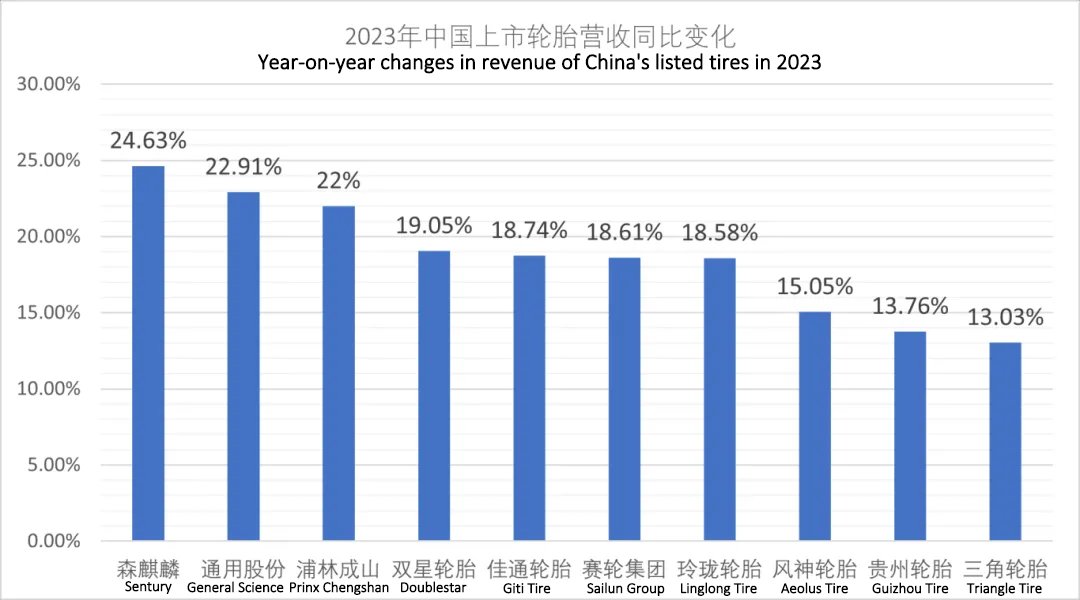

In 2023, the overall profitability of the tire industry has also improved significantly. Sailun Group's full-year net profit attributable to its parent company reached 3.091 billion yuan, a record high. The net profits of Triangle Tire, Linglong Tire, and Sentury were all over 1 billion, which was an absolute "bumper year".

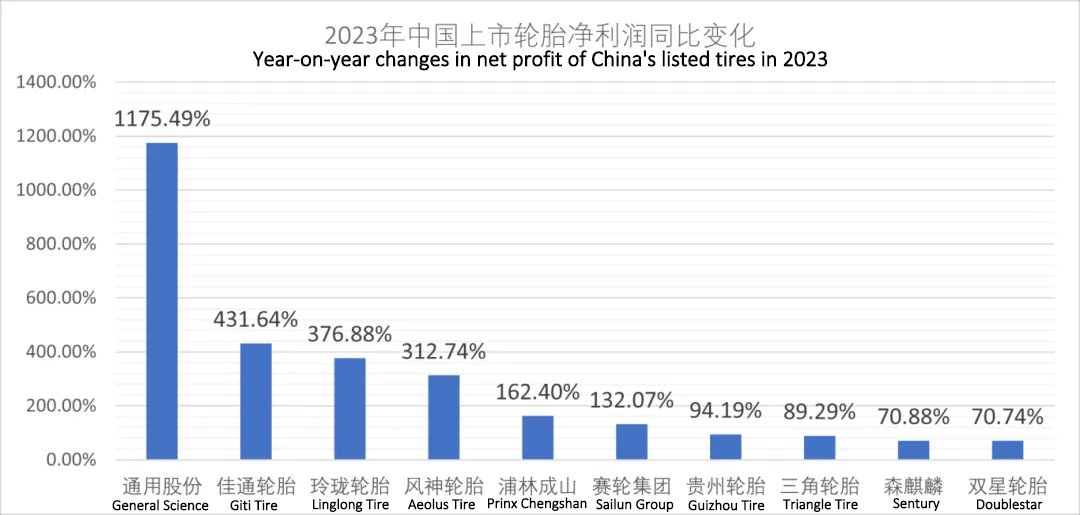

Compared with 2022, the net profits of the 10 listed tire companies have all achieved an increase of more than 70%, which is also very rare in the history of the industry. Among them, the net profit attributable to the parent company of General Science increased by 1175.49%, and its earning power is getting stronger and stronger; the net profit growth of Giti Tire, Linglong Tire and Aeolus Tire also exceeded 3 times.

In 2024, first-quarter performance continued to improve

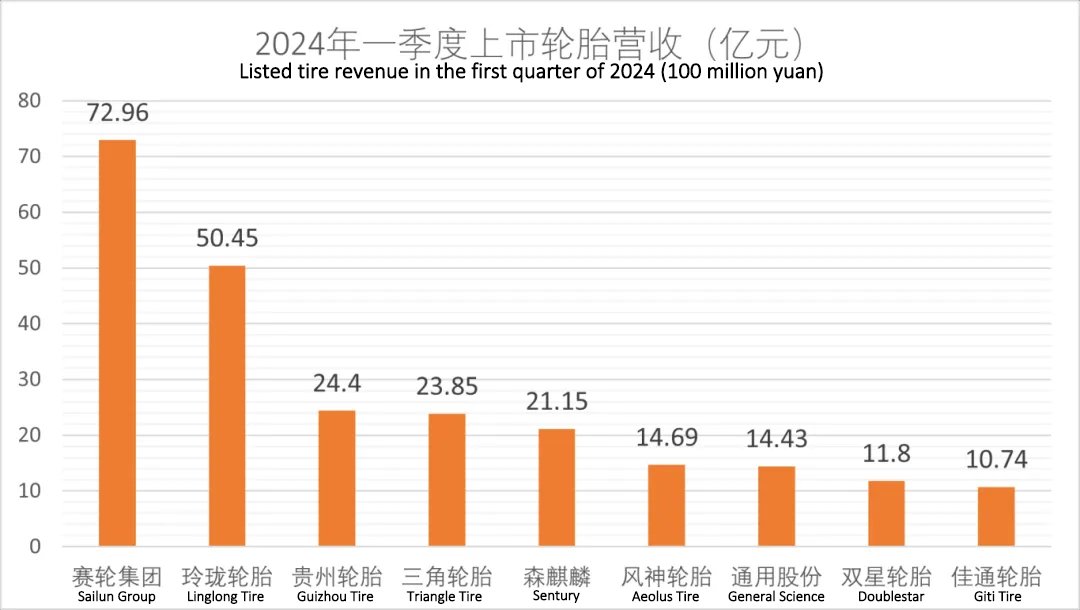

Entering 2024, the tire market continued to perform well in the first quarter, and the scale and strength of each A-share tire company has further increased. Sailun Group's first-quarter revenue reached 7.296 billion, firmly ranking first among listed tires. Linglong Tire's performance also continued to improve, with revenue in the first three months reaching 5 billion yuan. Guizhou Tire surpassed Triangle Tire and entered the top three listed tires.

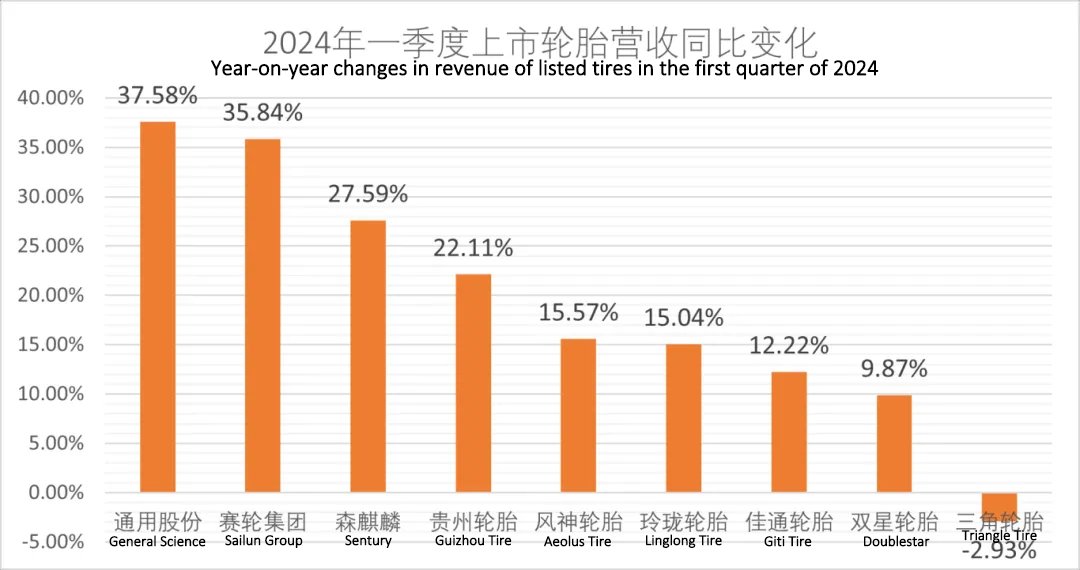

Benefiting from strong orders from overseas markets and domestic sales markets, the overall revenue of listed tires increased by more than 20% in 2024. Among them, GS's three major production bases at home and abroad made efforts at the same time, and sales increased by 37.58%; Sailun Group continued to maintain rapid growth, with revenue in the first quarter rising sharply by 35.84%.

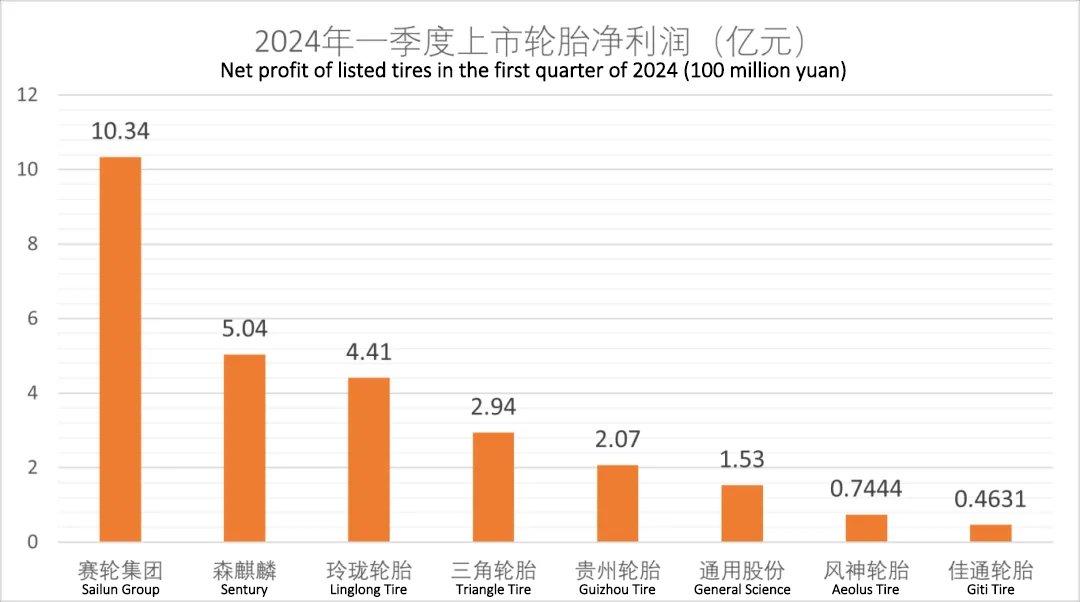

In the first quarter of 2024, the profitability of listed tires is also very gratifying. Sailun Group's first-quarter profit reached 1.034 billion yuan, Sentury made a net profit of 504 million yuan, and Linglong Tire made a net profit of 441 million yuan, laying a good foundation for the full-year performance.

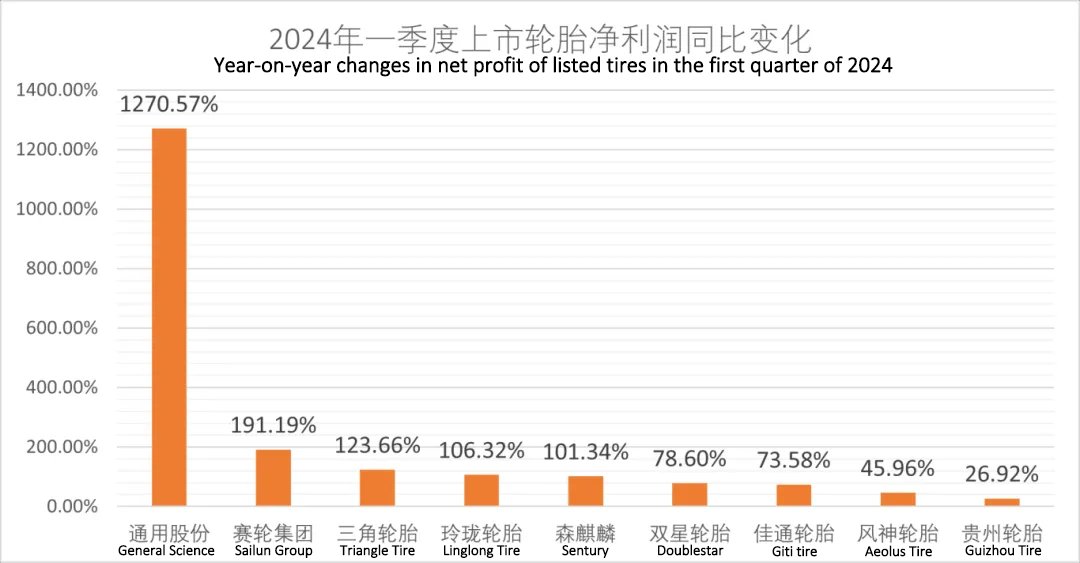

Compared with 2023, in addition to the 10-fold increase in net profit attributable to the parent company of General Science, the net profits attributable to the parent company of Sailun Group, Triangle Tire, and Linglong Tire have all doubled. In contrast, Aeolus Tire and Guizhou Tire, which mainly produce all-steel tires, have been affected by weakening market demand and have low profit levels, but they have also improved compared to 2023.

The performance of listed tire companies basically reflects the operation of the entire industry. Entering the second quarter, in terms of exports, overseas orders from most semi-steel tire companies remain active, which will still provide important support to demand for semi-steel tires in the second quarter.

There may be some pressure on all-steel tires. In the second quarter, overseas orders of various companies performed differently, with order activity weaker than the same period last year. In terms of domestic sales, after companies completed the downward transmission of finished product inventories in March, shipments slowed down in April, and competition in the domestic sales market will further intensify throughout the second quarter.

Based on the above situation, the industry expects that the capacity utilization rate of semi-steel tires will continue to run at a high level in the second quarter, while the capacity utilization rate of all-steel tires will gradually decline based on March.

Looking at the whole year, it will be difficult to continue the multiple positive factors of 2023 in 2024, but with the continued growth of global market demand and the rise of the domestic automobile industry, the tire industry's prospects are still promising!

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as bead winding line, hydraulic curing press for PCR/TBR, tire laser engraving machine, etc., please feel free to contact info@delphygroup.com.