In the rapid development of the tire industry, passenger tires are undoubtedly the main players, especially against the backdrop of the rapid rise of new energy vehicles in the past two years, what trends and changes will there be in the passenger tire retail market in 2024? What is the current breakthrough point for Chinese brands?

Recently, the authoritative research institution GFK released the "Global and Chinese Passenger Car Replacement Tire Market Review and 2024 Outlook", let's take a global look at the development of China's passenger tires.

01 Chinese brand, unique in the world

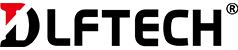

First of all, in 2023, the global passenger car replacement tire market has increased by 1.2% compared to the full-year retail volume in 2022, but the total volume is slightly lower than in 2021.

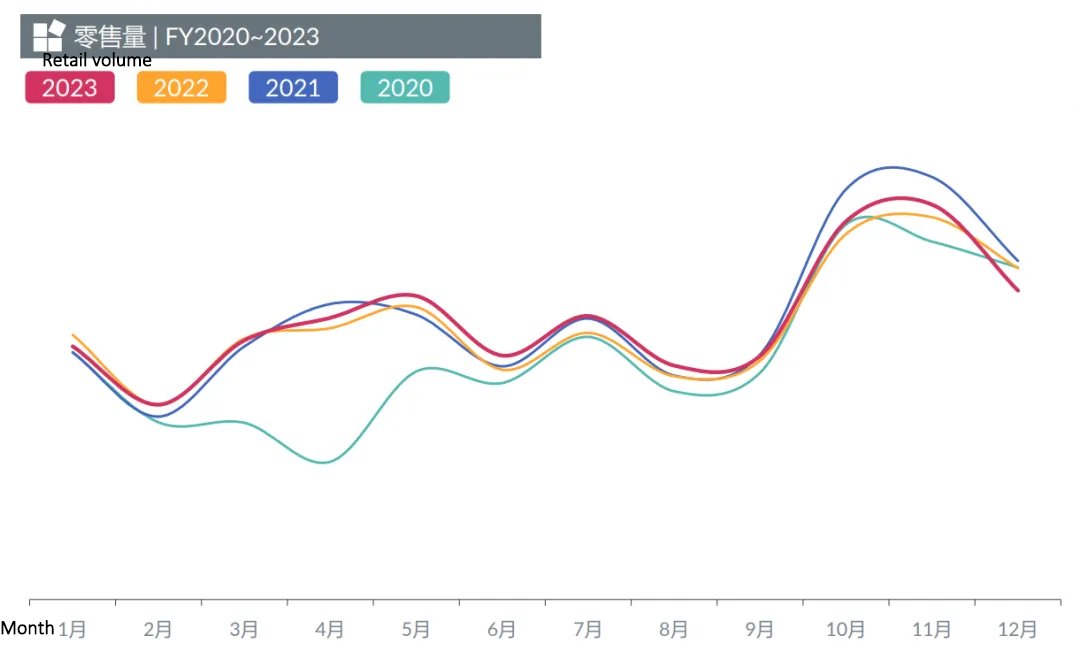

Data shows that Chinese brands have experienced faster year-on-year growth in the global passenger car replacement tire market than other brands. In 2023, the growth rate of Chinese brands is 14%, while other brands have no overall growth.

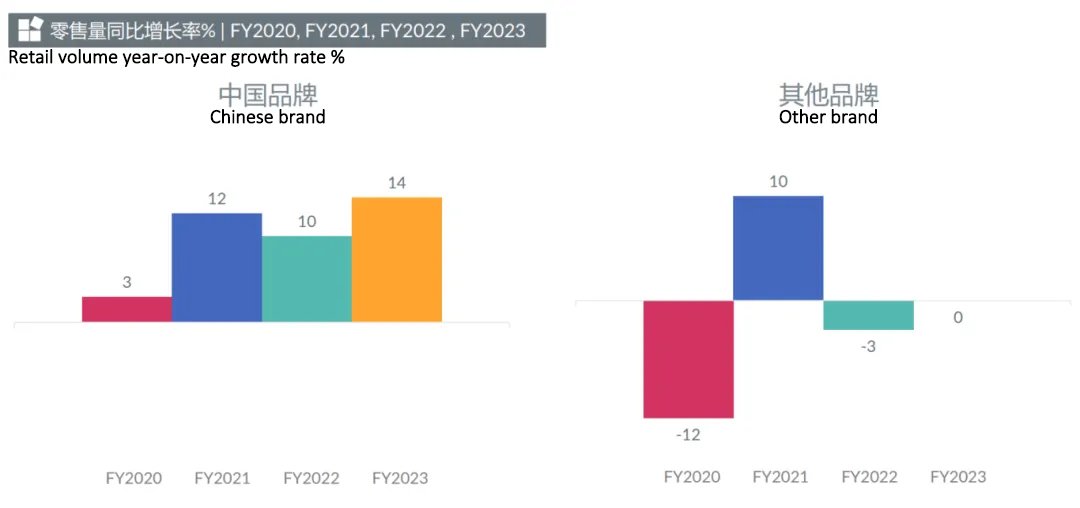

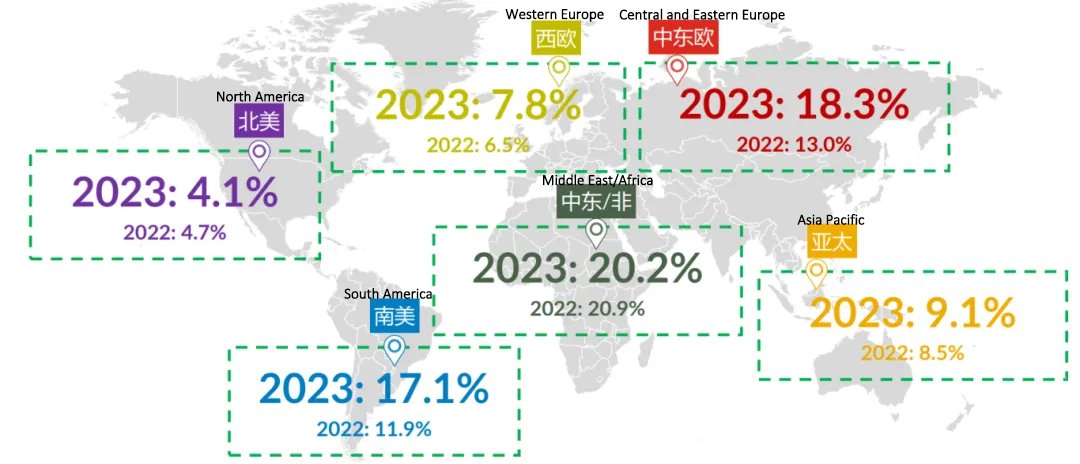

In terms of regions, throughout 2023, except for North America, the sales volume of Chinese brands in overseas markets increased year-on-year. Among them, the growth of other brands in South America, Western Europe, Central and Eastern Europe and the Asia-Pacific region is more significant.

Especially in South America, Chinese passenger tire brands grew rapidly by 50.8%, and Central and Eastern Europe also grew significantly by 40.4%. In the face of this brand confrontation, other brands have declined in South America and Central and Eastern Europe.

This trend is likely to continue in 2024, which means that the market share of Chinese brands in these regions will only increase.

Up to now, the Middle East/Africa region is the region with the largest export volume of Chinese passenger tires, accounting for 20.2%, followed by Central and Eastern Europe and South America.

2022-2023 Chinese brands retail sales share by region (%)

02 Retail sales reached 168 million units, large size tires are growing rapidly

In 2024, GFK predicts that the retail sales of passenger tires in China are expected to reach 168 million units, a year-on-year increase of 3.8% in 2023, becoming the locomotive driving the growth of the global tire market. Among them, offline sales increased by 2% and online sales increased by 15%.

From a product perspective, which tires are the most popular? GFK statistical estimates show that large-size products of 17 inches and above will continue to be the locomotive driving the growth of the Chinese market.

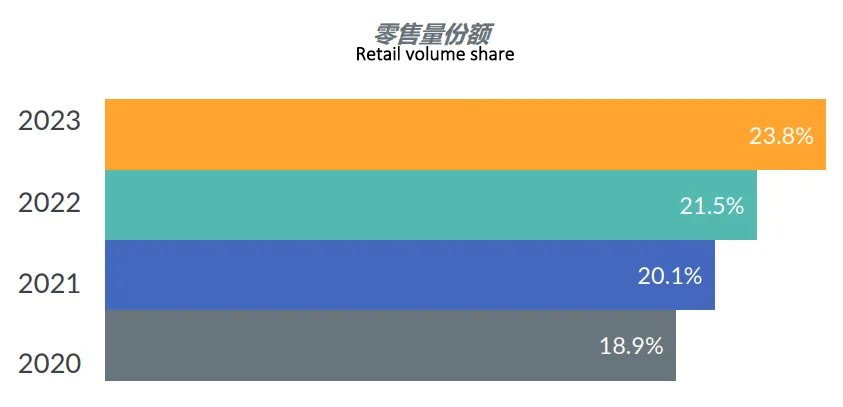

First of all, globally, over the past four years, the proportion of retail sales of large-size tires 18 inches and above in the global passenger car replacement tire market has continued to increase, and the growth rate has accelerated, with an increase of 23.8% in 2023 compared with 2022.

2020-2023 Retail growth rate of tires 18 inches and above

The continuous expansion of size has brought about the increasing market share of products in the high-price segment. The market share of those with prices above 800 yuan continues to expand, accounting for more than 25% in 2023.

At the same time, analysis shows that consumers also tend to choose some cost-effective products in each size segment, especially in 16-inch and 17-inch sizes.

03 New energy vehicle tire technology, growth rate 100%!

Another major factor influencing China's passenger tire retail market is the rise of new energy vehicles. As sales of new energy vehicles in China continue to rise, it is expected that the number of new energy vehicles will reach 39.4 million by 2025, accounting for 14.0%.

The number of new energy vehicles continues to rise, and it is expected that the growth rate of new energy vehicle tire patterns, silent sponge technology, and self-sealing technology will exceed 100% in 2024.

We have also seen that more and more domestic tire companies are investing in the research and development of the above technologies and launching corresponding products in a timely manner, which has become a major trend in the current tire market.

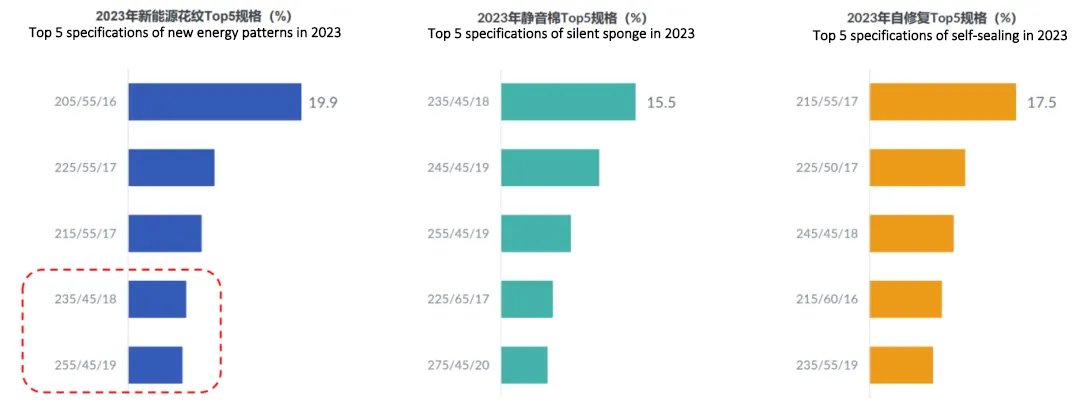

So, which specifications of new energy vehicle tires are currently the most popular?

GFK statistics show that judging from the ranking of best-selling specifications in 2023, the number one specification among new energy patterns is still 205/55R16; the number one specification of silent sponge is 235/45R18; the number one of self-sealing is 215/55R17, which remains unchanged from 2022.

It is not difficult to find that new energy vehicle tires also tend to be large-sized, and large-sized tires are destined to become a major trend in the future market.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as bead winding line, hydraulic curing press for PCR/TBR, tire laser engraving machine, etc., please feel free to contact info@delphygroup.com.