Recently, the National Bureau of Statistics announced the tire industry output in 2023. It can be said that in 2023, the tire industry has shown strong resilience and vitality, especially export support, which has led to strong expectations for 2024.

Nearly 1 billion, China ranks first in tire production in the world

In 2023, China's automobile production and sales exceeded 30 million units, a record high, driving growth in the supporting market. In addition, under the high inflation of the global economy, China's cost-effective tires have significant advantages, the drop in sea freight and high energy prices in Europe have provided a positive boost to tire exports.

Data show that in 2023, China's rubber tire casing production was 987.754 million units, an increase of 15.3% over the same period last year. The overall situation for the year exceeded expectations. According to global tire sales of 1.75 billion units in 2022, Chinese tires accounted for 56.46%, far ahead in the world.

Rubber tires include semi-steel tires, all-steel tires, cycle tires, etc., among which semi-steel tires and all-steel tires dominate the tire industry. Previously, according to CCTV reports, in 2023, the output of all-steel tires in China was 139 million, a year-on-year increase of 14%; the output of semi-steel tires was 591 million, a year-on-year increase of 22%.

In December 2023, China's rubber tire casing production was 86.87 million units, a year-on-year increase of 23.8%. According to Longzhong Information estimates, in December 2023, China's semi-steel tire production was 54.74 million units, a month-on-month decrease of 0.42% and a year-on-year increase of 28.38%; China's all-steel tire production was 11.57 million units, a month-on-month decrease of 7.22% and a year-on-year increase of 4.33%. Tire production in December fell month-on-month, but was significantly improved compared to last year.

Exporting 600 million units, Chinese tires are best-selling globally

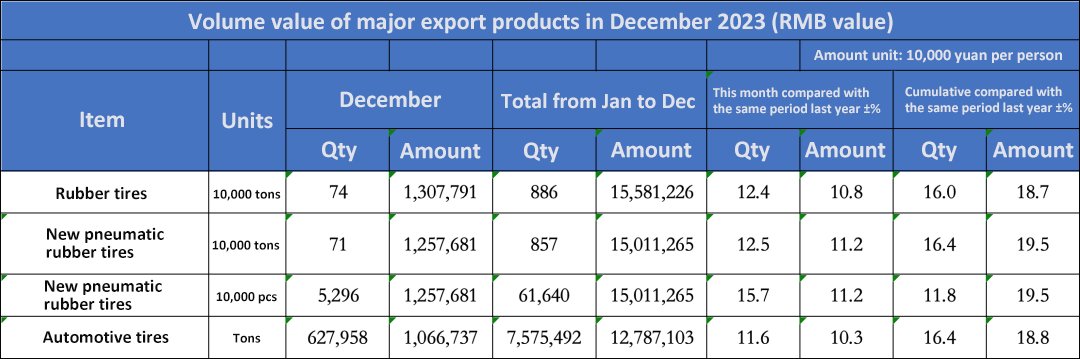

China's tire foreign trade exports are still the main force. Data released by the General Administration of Customs show that in 2023, China exported a total of 616.4 million new pneumatic rubber tires, an increase of 11.8% year-on-year in 2022; the export value was 150.11265 billion yuan, a year-on-year increase of 19.5%; the export of automobile tires was 7.575492 million tons, a year-on-year increase of 16.4%.

In December, the country exported a total of 52.96 million new pneumatic rubber tires, a year-on-year increase of 15.7%, and the export value was 12.57681 billion yuan, a year-on-year increase of 11.2%. Among them, automobile tires exported 627,958 tons in December, an increase of 11.6% year-on-year.

Among them, in 2023, China's export sales of semi-steel tires were about 287 million, a year-on-year increase of 20%; the cumulative export volume of passenger car tires was 7.8766 million tons, a cumulative year-on-year increase of 20.29%; the cumulative export volume of truck and bus tires was 4.6181 million tons, and the cumulative export volume increased by 4.23%.

Chinese tires look at Shandong. In 2023, Shandong Province's rubber tire exports reached 92.36 billion yuan, a year-on-year increase of 20.6%. Among them, according to local reports, in 2023, Dongying City's rubber tire exports increased by 20.2%, and Linyi City's annual rubber tire exports were 7.77 billion yuan, an increase of 22.9%.

In 2024, the head tires will be stronger

Looking forward to 2024, according to CCTV interviews, at present, many tire companies' orders have been scheduled for two months, and inventories are at a low level.

In particular, many leading tire manufacturers are optimistic about the market situation in 2024. Sentury Tire said: "At present, the company's export orders are full, the factory is at full production, and the market prosperity is very high."

The relevant person in charge of Sailun Tire said: "The production and sales boom will continue in 2024, among them, overseas demand for products such as engineering tires and giant tires is still high."

A relevant person in charge of General Science said: "The company's overseas base orders are still full and supply exceeds demand; from a domestic perspective, macroeconomic policies and industry recovery are still continuing, and dealers’ good start activities after the Spring Festival will also drive industry prosperity and order demand."

According to analysis by many industry insiders, the semi-steel tire market will grow steadily in 2024, and the all-steel tire market will be under greater sales pressure. In addition, the performance of leading companies will be stronger, while companies with weak brand power and serious homogeneity will face certain operating pressures.

DLFTECH is a professional equipment service company established by a senior marketing and R&D team in tire and rubber conveyor belt equipment industry. Leading by automation process equipment demand, the company is committed to the docking of intelligent equipment and technology, to achieve zero distance technique process and bring new profit growth points and continuous market competitiveness to customers. Select DLFTECH, so you have the best solution, always!

If any tire or conveyor belt industry customers need such as rubber track equipment, intelligent laser cleaning system for tire mold, hydraulic curing press for PCR/TBR, bead wrapping machine, etc., please feel free to contact info@delphygroup.com.