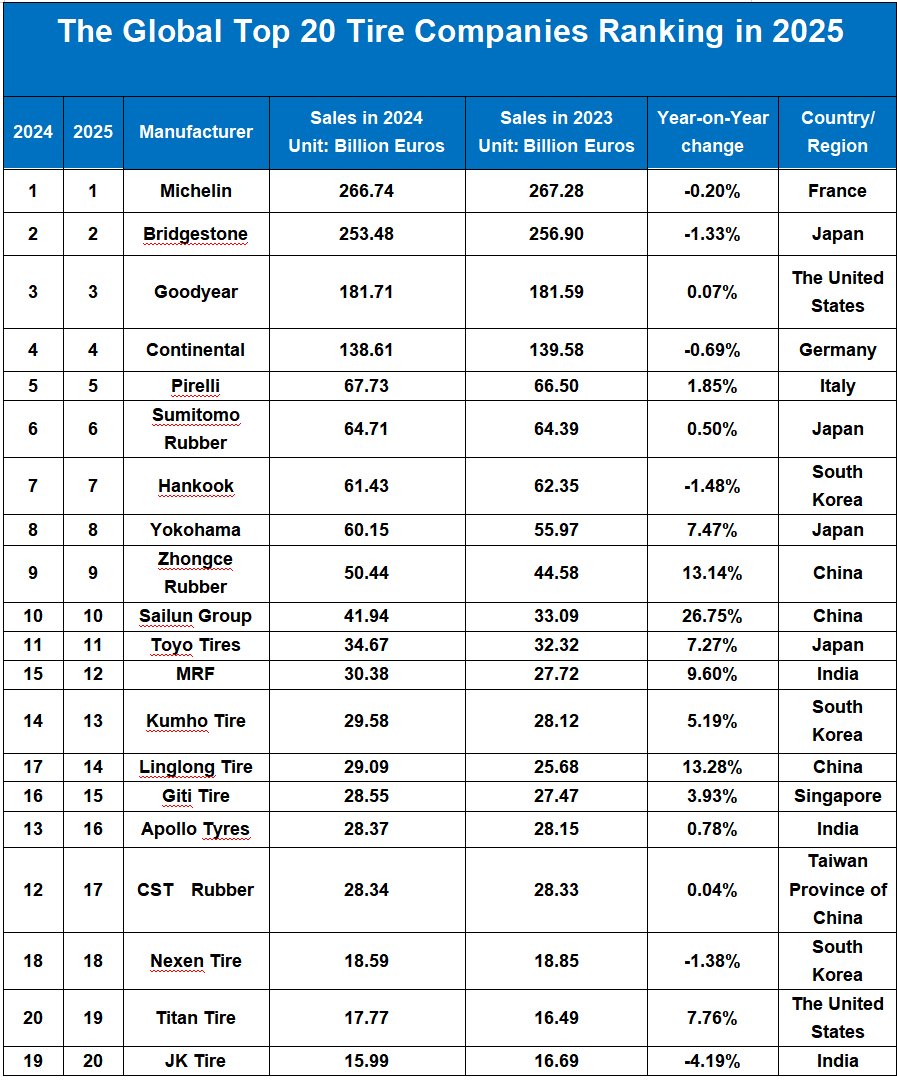

Recently, the British media "Tyrepress" released the latest list of the world's top 20 tire companies based on their sales in 2024.

Now let's take a look at what changes have occurred in the rankings of the top 20 global tire companies over the past year.

The top ten global tire companies remain unchanged in ranking.

This year, the top ten global tire companies have remained exactly the same as last year, which basically confirms that the industry's leading position has become stable.

However, a closer look reveals a trend: among the first-tier global tire manufacturers with sales exceeding 10 billion euros, Michelin, Bridgestone, and Continental all saw their sales decline, which is extremely rare; Goodyear's sales increased by merely 0.07%.

In addition, Hankook Tire, which had seen particularly rapid growth in previous years, also experienced a decline in 2024; Sumitomo Rubber and Pirelli, compared with 2023, saw their performances remain largely flat.

Among the top ten, three companies stood out particularly, namely Yokohama, Zhongce Rubber and SAILUN Group. Notably, the latter two Chinese enterprises both achieved double-digit growth in sales compared to the previous year.

Yokohama's growth was mainly attributed to the acquisition of Trelleborg Wheel Systems, which was officially integrated into the group's performance in 2024. Excluding this part, its sales were basically on par with those in 2023. Zhongce and Serein, on the other hand, saw genuine growth.

In 2024, Zhongce Rubber's two independently developed technology system platforms, "Tian Gong" and "Tian Ji", were launched with great fanfare, marking China's first major breakthrough in the tire basic research system. This achievement broke the long-standing monopoly of the European and American tire industry giants in the technology system and boosted the sales of its main products to approximately 216 million units, with a capacity utilization rate of 95.17% and a sales-to-production ratio of 99.61%.

At present, the first phase of Zhongce Indonesia's MTI Company has officially started production, the factory in Mexico has officially broken ground, and the factories in Tianjin, Jintan, Dajiangdong and Fuyang are expanding and upgrading. This further strengthens the dual circulation at home and abroad. Meanwhile, Zhongce Rubber officially listed on the main board of the Shanghai Stock Exchange on June 5th, which is expected to further boost its leapfrog development.

In 2024, Sailun achieved record-high production and sales volumes of tires, reaching 74.8111 million and 72.1558 million respectively, with growth rates of 27.59% and 29.34%. In the second quarter of this year, the first tires rolled off the production lines at Sailun's two overseas factories in Indonesia and Mexico, and their production capacity is gradually being released. It is expected that this will drive the company's performance to continue to strengthen throughout 2025.

From 11th to 20th, Linglong performed outstandingly.

Compared with the stability of the top ten rankings, the rankings from 11th to 20th have undergone significant changes. Firstly, the fastest risers are India's MRF and China's Linglong Tire, each climbing three places. Notably, Linglong Tire saw a year-on-year sales growth of 13.28%, making it the fastest-growing company in this range.

Kumho, Giti, and Titan also saw their rankings rise. Among them, Titan International acquired Carlstar Group in 2024, a US-based specialty tire manufacturer ranked 42nd globally. This year, JK Tyre from India dropped one place; Apollo Tyres fell three places; and CST Rubber declined by five places. In terms of sales alone, Apollo and CST's performances were roughly the same as in 2023, with their rankings dropping mainly due to the rapid growth of other companies.

Overall, the sales gap between the 11th and 20th positions on the list is only around 1.8 billion euros, indicating that competition among companies in this range is more intense and rankings are more prone to change.

The global tire market: Rising in the East, falling in the West.

Looking at the entire top 20 list, it is not difficult to notice that the phenomenon of "the East rising and the West falling" in the tire industry is becoming increasingly obvious. In 2024, affected by geopolitical factors, the uncertainty of the global trade environment has greatly increased. The tire industry in Europe and America is continuing to close factories and lay off workers. The supply and demand relationship in the global tire market is changing rapidly. Chinese tires are accelerating their overseas expansion, and their cost-effectiveness is triggering a "global replacement". In contrast, in China, judging from the performance of various listed tire companies on the A-share market, the profitability and scale strength of Chinese tires have further expanded. At the same time, various new projects are constantly being launched to accelerate the capture of the global market.

In April 2025, the output of rubber tires in China was 102.002 million pieces, an increase of 3.1% year-on-year. From January to April, the output of rubber tires increased by 3.7% year-on-year to 385.58 million pieces. In terms of exports, from January to April, the cumulative export volume of rubber tires in China reached 3.03 million tons, an increase of 6.2% year-on-year; the export value was approximately 53.879 billion yuan, an increase of 6.6% year-on-year; the cumulative export volume of new pneumatic rubber tires in China in the first four months was as high as 226.81 million pieces, an increase of 8.3% year-on-year.

However, it is necessary to be vigilant that the domestic tire market is becoming increasingly polarized. Although the market for semi-truck tires is thriving due to the downgrading of consumption both at home and abroad and the growth in China's auto sales, the market for all-truck tires is experiencing a contraction in demand due to the slowdown in global and domestic infrastructure projects.

Furthermore, the European Union initiated an anti-dumping investigation into passenger car tires from China this year. With the rise of global trade protectionism, Chinese tires need to abandon the low-price competition route, improve their internal capabilities, and achieve an upgrade in brand and quality.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as OTR bead winding line, tire mold laser cleaning system, track shaping & curing press etc., please feel free to contact info@delphygroup.com.